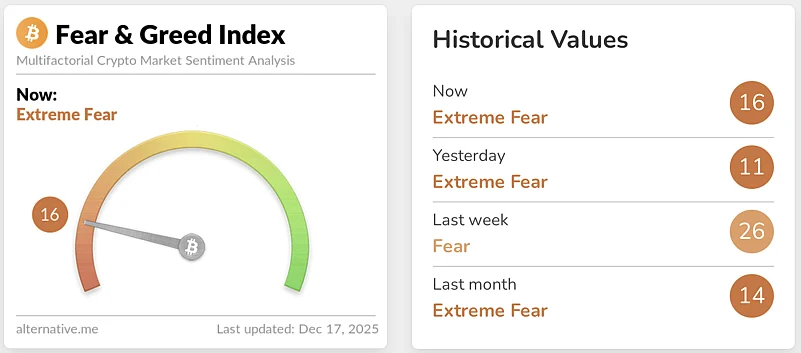

The crypto market has entered one of these phases that is uncomfortable, but familiar to experienced crypto investors. The Crypto Fear and Greed Index from Alternative.me has dipped down into the fear zone again, as a result of rising mistrust throughout trading desks and at the retail level. Volatility has kicked in and short term confidence has eased, many traders have decided to sit back and take cover instead of leaning in.

These moments are going to feel worse in the moment more than they do looking back. Fear readings do not normally show up during fundamentally broken markets. More likely, they come out in pauses, pullbacks or uncertainty induced by macro noise. For investors who have observed multiple cycles in action, this emotional reset is often the initial indicator that an opportunity is being created.

What The Fear Index Is Actually Telling Us

The Fear and Greed Index is not a price direction prediction technique. Instead it captures collective behavior. It combines the data of volatility, volume trends, dominance levels and social engagement into one picture of sentiment. When fear is at the forefront, it most often indicates that traders are acting on emotions, and not their strategy.

Throughout past cycles there have been prolonged readings of fear that have coincided with accumulation areas rather than distribution periods. Markets have a tendency to go too far emotionally in one direction before going back. This is why experienced investors use fear as context, and not as a basis for not even getting involved.

Why Smart Money When Others Are Hesitant

Contrarian investing sounds easy but is hard to implement. Buying when the sentiment is weak takes patience and conviction. Research and commentary from outlets like CoinDesk have time and again shown that big investors pull out all the stops to accumulate positions in fearful conditions, well before the good times arrive.

Less competition is enabled when fewer people are willing to buy. Liquidity is still present, however, emotional sellers dominate short term flows. This imbalance gives disciplined capital the opportunity to enter stealthily and often at levels that will be unavailable when confidence returns.

Whale Accumulation Often Starts In Silence

Looking at the chain behavior from previous cycles shows a regular behavior. Large wallets don't usually wait for the social sentiment to turn positive. Accumulation typically begins when uncertainty is high. This pattern was in place ahead of prior meme cycles for assets such as SHIB and PEPE where early positioning was well ahead of the retail excitement.

Fear phases provide the perfect conditions for this approach. Attention is low, expectations are muted and narratives have not yet reignited. For long term participants this is often when the most meaningful positioning occurs.

Pepeto Fits The Accumulation Phase Story

Pepeto ($PEPETO) is currently positioned in this cautious market environment. Despite greater hesitancy, the project has raised over $7.1 million during its presale, meaning that there is still a chunk of greater investors who are willing to commit capital while the sentiment is still uncertain about the project.

The nature of the presale structure itself encourages this behavior. Without exposure to intraday exchange volatility, the investors have the opportunity to build positions gradually rather than reacting to short term price swings. This controlled entry process is quite allied to how experienced capital wants to give funds in undecided phases.

Utility Driven Design Supports Long Term Conviction

Pepeto is not a short lived hype play positioned. Built on Ethereum mainnet, the project is adding zero fee PepetoSwap, a planned cross chain Pepeto Bridge, and a Pepeto Exchange, which is focusing on verified meme utility tokens.

Any action within the ecosystem runs through the $PEPETO token. This design also ties future usage directly to demand, resulting in having a structural underpinning that goes beyond sentiment driven attention. For investors who are accumulating in fear phases, such a utility narrative provides them an extra level of confidence.

Audits And Yield When Confidence is Low

When markets are feeling shaky, investors always become more picky. This is something Pepeto addresses by pointing to smart contract audits from SolidProof and Coinsult as a way to reduce the level of risk in a technical way when trust means more than hype.

Staking rewards about high APY further makes the accumulation case stronger. Yield gives participants the ability to grow their allocation during the wait and wait for sentiment to improve, as patience becomes a measurable advantage instead of being passive.

Why Memes Seasons Often Come After A Period of Doubling

Meme driven rallies are seldom initiated in euphoric conditions. They are likely to appear after long periods of hesitation, after capital starts to rotate back towards higher risk opportunities again. Fear phases clear away over-leveraging and the tide of expectations to arrive for new narratives to gain ground.

As confidence is rebuilt, capital often moves to projects that have the highest upside potential. Meme utility plays with structure are disproportionately benefitting from this shift.

A Small Opening That Closes At A Rapid Speed

Sentiment can be changing quicker than most expect. Once fear readings stabilize and optimism has been restored, prices often adjust rather rapidly because sidelined capital returns to the market. By that time, the opportunities for early entry are typically past.

Pepeto (PEPETO) is within this narrow accumulation window. For investors open to taking action while timidity may still prevail, the project represents exposure in advance of meme season plotlines and pre-impermanence in valuations.

How to Buy Pepeto (PEPETO)

To invest in this promising opportunity ahead of its launch, head to the official site at https://pepeto. , link your MetaMask or Trust Wallet, and complete your purchase using USDT, ETH, BNB, or a bank card. Buyers can also activate staking right away and earn high APY while waiting for the tier 1 listing to go live.

Disclaimer: Always verify that you are using the official Pepeto website. As the project gains attention, imitation pages may appear.

Official Channels:

Website: https://pepeto.io

Telegram: https://t.me/pepeto_channel

Disclaimer: Cryptocurrency investments are risky and highly volatile. This is not financial advice; always do your research. Our editors are not involved, and we do not take responsibility for any losses.